Press

From Atlantic Canada to the US: Atlantic Fintech and Wellesley Hills Financial Partner to Accelerate Fintech Growth

Moncton, New Brunswick, 13 January 2026 – Atlantic Fintech has announced a new strategic partnership with Wellesley Hills Financial to provide customized financial support to one standout company within the Atlantic Fintech Growth Network. The collaboration represents a significant step forward in strengthening the region’s fintech ecosystem, offering tailored financial solutions that could include strategic investment, mergers and acquisitions guidance, or growth financing. The Atlantic Fintech Growth Network was established to drive the development and global competitiveness of fintech innovators across Atlantic Canada into international markets. Through mentorship, funding connections, strategic insights and high-impact partnerships, the program enables participating companies to scale faster and expand

Capital Markets Tech / WealthTech

FX Risk Management Fintech Bound Lands $24.5M Series A

UK-based fintech Bound has raised $24.5 million in Series A funding to accelerate the expansion of its advanced technology platform for foreign exchange risk

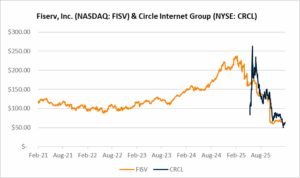

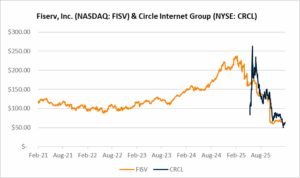

Chart Of The Week

NASDAQ: FISV

Fiserv, a major player in payments and financial services technology (NASDAQ: FISV), officially launched INDX on February 12, 2026. This is a real-time cash

Blockchain

Fiserv Launches INDX for Real Time Settlement of Digital Assets in U.S. Dollars

Fiserv has launched INDx, a real-time cash-settlement platform that allows digital-asset companies to store and transfer U.S. dollars around the clock. INDx connects traditional

E-commerce

Etsy Shares Jump After Depop Sale; Demand Pressures Weigh On Results

Etsy shares rose about 10% after the company agreed to sell its Gen Z-focused resale platform Depop to eBay for nearly $1.2 billion, a

Embedded Finance

Array Acquires Chimney to Expand Digital Financial Tools for Institutions

Array, a leading provider of embeddable financial solutions for top fintechs, financial institutions, and digital brands, has acquired Chimney, a New York-based fintech recognized

Fintech

UK Insurtech Marshmallow Raises $90M

U.K. fintech and insurtech startup Marshmallow has raised $90 million in debt and equity in a round led by Portage Capital, with participation from BlackRock

IDV / AML / KYB / Biometrics

Indian Regtech IDfy Bags Over $52M in Series F Round

IDfy, an Indian identity verification and regtech platform, has raised over $52 million in a Series F round, comprising $24 million in primary capital led

Investment - M&A

Rex Software, Cirrus8 and RealTrust Merge to Create Industry Leader

Rex Software has joined forces with Cirrus8 and RealTrust Property Accounting Solutions to create a leading real estate software and solutions provider for residential and

Open Banking

Backbase and Plaid Partner to Bring Open Finance to AI-Powered Banking

Backbase and Plaid have partnered to integrate Plaid’s real-time financial data connectivity with Backbase’s AI-powered banking platform. This addresses data fragmentation and legacy system silos

Payments

Visa to Buy Payment Firms Prisma, Newpay to Deepen Argentina Footprint

Visa has entered into a strategic partnership with Prisma and Newpay to enhance Argentina’s digital payment infrastructure. This collaboration is designed to drive increased

PropTech

Stake Raises USD 31 Million in an Oversubscribed Series B to Scale Regulated Global Real Estate Investing

Stake, the region’s leading digital real estate investment platform, has raised $31 million in an oversubscribed Series B led by Emirates NBD, with participation

Saas

Fifteenth Announces $8.25 Million in Seed Funding to Help Tech Professionals Navigate Complex Taxes with Ease and Automation

Fifteenth, a tax solution designed for tech professionals with complex financial situations, has secured $8.25 million in seed funding led by A* and General Catalyst.

Specialty Finance / LendTech

Fintech Firm Newity Raises $11 Million to Bring Small Business Loans Onchain

Newity raised $11 million in its first funding round, led by CMT Digital and structured as a SAFE, to support plans to bring its

Press

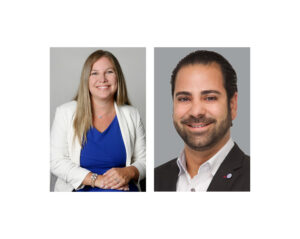

Fintech Investment Bank Wellesley Hills Financial Expands Capabilities with New Executive Advisors

Announces addition of two recognized fintech and payments leaders to the team NEWTON, Mass.–(BUSINESS WIRE)–Wellesley Hills Financial, a global investment bank and strategic advisory

Week's Most Interesting

Capital Markets Tech

FX Risk Management Fintech Bound Lands $24.5M Series A

UK-based fintech Bound has raised $24.5 million in Series A funding to accelerate the expansion of its advanced technology platform for foreign exchange risk

Chart Of The Week

NASDAQ: FISV

Fiserv, a major player in payments and financial services technology (NASDAQ: FISV), officially launched INDX on February 12, 2026. This is a real-time cash settlement

Crypto

Fiserv Launches INDX for Real Time Settlement of Digital Assets in U.S. Dollars

Fiserv has launched INDx, a real-time cash-settlement platform that allows digital-asset companies to store and transfer U.S. dollars around the clock. INDx connects traditional banking

Embedded Finance

Array Acquires Chimney to Expand Digital Financial Tools for Institutions

Array, a leading provider of embeddable financial solutions for top fintechs, financial institutions, and digital brands, has acquired Chimney, a New York-based fintech recognized for

E-commerce

Etsy Shares Jump After Depop Sale; Demand Pressures Weigh On Results

Etsy shares rose about 10% after the company agreed to sell its Gen Z-focused resale platform Depop to eBay for nearly $1.2 billion, a move

Fintech

UK Insurtech Marshmallow Raises $90M

U.K. fintech and insurtech startup Marshmallow has raised $90 million in debt and equity in a round led by Portage Capital, with participation from

Fraud/Risk Management

Indian Regtech IDfy Bags Over $52M in Series F Round

IDfy, an Indian identity verification and regtech platform, has raised over $52 million in a Series F round, comprising $24 million in primary capital led

Investments - M&A

Rex Software, Cirrus8 and RealTrust Merge to Create Industry Leader

Rex Software has joined forces with Cirrus8 and RealTrust Property Accounting Solutions to create a leading real estate software and solutions provider for residential

Open Banking

Backbase and Plaid Partner to Bring Open Finance to AI-Powered Banking

Backbase and Plaid have partnered to integrate Plaid’s real-time financial data connectivity with Backbase’s AI-powered banking platform. This addresses data fragmentation and legacy system silos

Payments

Visa to Buy Payment Firms Prisma, Newpay to Deepen Argentina Footprint

Visa has entered into a strategic partnership with Prisma and Newpay to enhance Argentina’s digital payment infrastructure. This collaboration is designed to drive increased

Stake Raises USD 31 Million in an Oversubscribed Series B to Scale Regulated Global Real Estate Investing

Stake, the region’s leading digital real estate investment platform, has raised $31 million in an oversubscribed Series B led by Emirates NBD, with participation from

Saas

Fifteenth Announces $8.25 Million in Seed Funding to Help Tech Professionals Navigate Complex Taxes with Ease and Automation

Fifteenth, a tax solution designed for tech professionals with complex financial situations, has secured $8.25 million in seed funding led by A* and General Catalyst.

Specialty Finance / LendTech

Fintech Firm Newity Raises $11 Million to Bring Small Business Loans Onchain

Newity raised $11 million in its first funding round, led by CMT Digital and structured as a SAFE, to support plans to bring its small-business