In June 2025, Circle Internet Group, Inc. (NYSE: CRCL), a prominent organization in the stablecoin sector, announced a global partnership with Fiserv, Inc. (NYSE: FI), a leading provider of payment and financial technology solutions. The strategic alliance aims to incorporate Circle’s USDC stablecoin solution into Fiserv’s extensive ecosystem, which comprises 10,000 financial institutions and six million merchant locations processing 90 billion transactions annually. The collaboration is designed to facilitate real-time, cost-effective, and cross-border payment capabilities for banks, fintechs, and merchants, incorporating both business-to-business (B2B) and consumer-to-business (C2B) models.

History and Background.

Since the emergence of the international banking system in the 17th century, beginning with institutions such as the Medici merchant bank in Florence and subsequently, financial centers in Amsterdam and London, cross-border payments have been facilitated by letters of credit. For several centuries, these instruments proved effective, enabling robust intra-European trade. Following World War II, the Bretton Woods Agreement led to the establishment of the International Monetary Fund (IMF), which initially concentrated on standardizing banking practices through central banks in 44 member countries. The creation of the IMF paved the way for future modernization efforts.

In 1973, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) was introduced as a new international messaging platform, electronically connecting major banks across IMF member nations via a network of cables and telexes, and an important piece of a new global B2B payment network was established. SWIFT’s primary function has always been message-centric: it notifies a receiving bank that an originating bank overseas intends to deposit a specified amount into a particular account on a given date, after which the receiving bank sends confirmation (today, better understood as the clearing process). It should be noted that the actual transfer of funds (or settlement process) is facilitated by a separate network.

SWIFT represented a significant improvement over the traditional, labor-intensive, paper-based letter of credit process and quickly gained widespread adoption. However, its rapid expansion also resulted in a dramatic increase in transaction volumes, placing considerable strain on the back offices of financial institutions worldwide.

Fast Forward.

Today SWIFT offers a standardized and secure B2B messaging platform that enables financial institutions to exchange payment-related information, such as payment instructions, beneficiary details, and other essential data. For more than four decades, SWIFT has served as a cornerstone of global finance, annually facilitating nearly half of all cross-border payments worldwide. Connecting 11,000 banks across 200 countries, SWIFT processes approximately 50 million messages daily, representing a peak of $5 trillion in daily transaction value but leveling off at $180 trillion annually over 250 business days.

But International B2B Is Still Far from Perfect.

As essential to international cross-border payments as SWIFT has become, it is still constrained in four key ways: speed, cost, information and volume.

SWIFT transfers can take several days, cost over 300bps, and incur error rates above 5%, making them slow and expensive by modern standards. To address these pain points, SWIFT launched ISO 20022 in March 2023, an XML-based platform that is faster, cheaper, more user-friendly, and less error-prone.

SEPA (Single Euro Payments Area) and CHIPS (Clearing House Interbank Payments System) are international payment networks that operate alongside SWIFT. SEPA facilitates euro-denominated transactions across European borders, streamlining cross-border payments within the eurozone. CHIPS is a private-sector, real-time gross settlement (RTGS) system that manages the clearing and settlement of large-value, time-sensitive payments in U.S. dollars.

According to The International Bank of Settlements, there are approximately 40,000 banks worldwide. Of these, around 20%-25% are connected through a combination of SWIFT and international payment networks. Banks that are not part of these networks use intermediary correspondent banks to facilitate transactions with participating institutions. Correspondent banks aggregate connectivity and provide services such as credit, treasury management, and liquidity support for smaller respondent banks involved in pending transactions. While correspondent banks play a role in the international money transfer system, their involvement can result in additional cost and processing time.

Its exactly this type of kludgy financial infrastructure that has spurred demand for alternative platforms, especially those enabled by blockchain technology.

Enter USDC Issuer and Stablecoin Infrastructure Leader Circle.

Business, product summary, and use cases:

- Circle’s flagship product, the United States Digital Coin (USDC) is the second most used stable coin globally. USDC is 100% backed (1:1) by cash and short-term government securities. The company’s recently launched Euro Digital Coin (EURDC) works on the same principle. Circle generates transaction revenues from redeeming USDC and interest income from customer deposited currency reserves backing each USDC stable coin.

- USDC is regulated and transparent, the face value of a USDC token is always known, as is its ability to convert into US dollars through the company or a crypto exchange, including into any fiat currency, 24/7/365.

- In our opinion, Circle answers the call for industrial strength, global, and legitimate next generation payments platform for businesses and consumers.

- There are many benefits to using USDC, including: fast (almost immediate) and low-cost transaction processing anywhere in the world. Cross-border remittance is a natural market which is traditionally expensive on a dollar value sent basis (consumers), and slow for international B2B transactions (may require several days). The combined service revenue opportunity is over $100 billion.

- USDC is natively compatible with 16 blockchain networks and has portability capability to other Ethereum Virtual Machine (EVM) and non-EVM chains. Circle also provides their own wallets and smart contract platform.

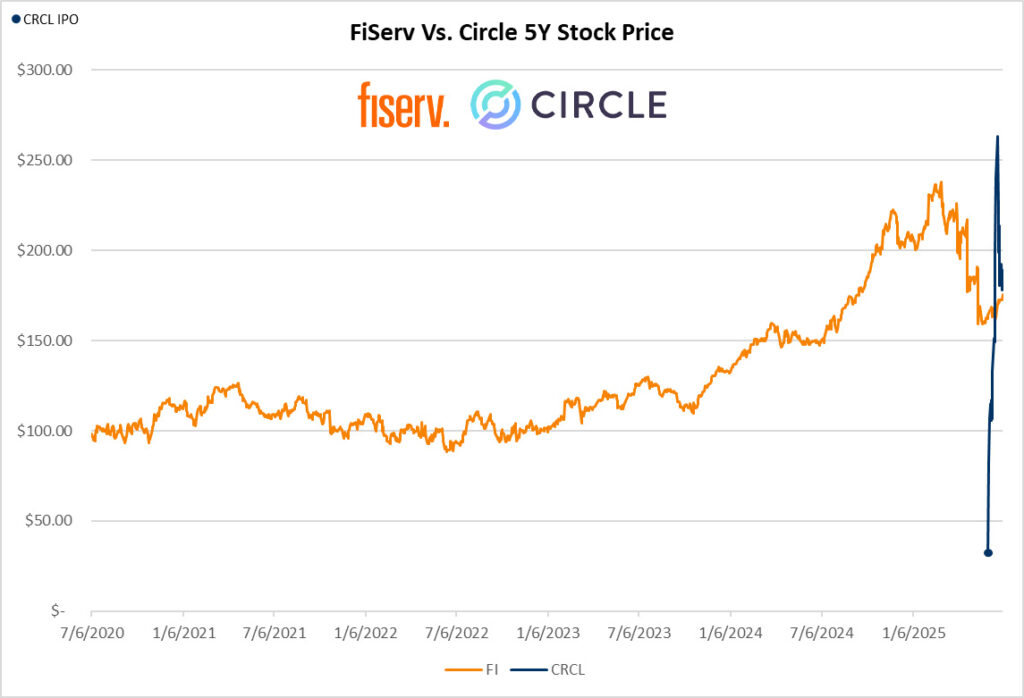

- Circle went public in an initial public offering on June 5, 2025, and now has a $40 billion market cap, and is riding a wave of positive momentum following the recent US Senate passing of the Genius Act. These guidelines provide legal structure to the legitimacy of stablecoin companies in the US, which was previously lacking.

- USDC use cases have potentially seismic implications for the pricing and speed of B2B and C2B transactions. From what we can tell, many of the use cases for USDC carry a transaction fee that is approximately half of the “standard rate”, and this with a faster clearing time.

- The Merchant Discount Rate (MDR) on average for the small and medium sized retailers in the US is between 2-3% vs USDC potential 1%. If third party service providers are involved, and other services wrapped around the USDC transaction, that rate could go higher. None the less, the base rate will start at a much lower price point compared to the traditional four-party payment system of 1) Card Brand (Visa/Mastercard/Amex/Discover), 2) Card Issuer (Financial Institution like Bank of America), 3) Merchant (PoS location) and 4) Consumer.

In sum, for the first time in decades, the face of the C2B and B2B payments is changing.

Payments could be faster and cheaper than current alternatives, and perhaps more importantly, contain rich data packets for every transaction.

The Circle / Fiserv Thesis.

The primary goal of the Circle and Fiserv partnership is to develop and deploy stablecoin-enabled solutions that facilitate high-speed, low-cost transactions, operate 24/7, supporting both domestic and cross-border payment use cases. The partnership is designed to meet the growing demand for real-time, borderless financial experiences, leveraging the interoperability of regulated digital dollars to streamline settlements and expand global reach.

Some investors may be surprised to learn that outside the US, the cross-border B2B payments market processes over $22 trillion annually on blockchain technologies and this CRCL/FI collaboration is a natural extension of that trend. For example, this could be a significant step toward enabling stablecoin technology for everyday payments, including C2B, which has been lacking.

Fiserv is also launching its own stablecoin, FIUSD, which will be integrated into its existing banking and payments infrastructure by the end of 2025. FIUSD will utilize stablecoin infrastructure from both Circle and Paxos and will be available on the Solana blockchain, known for its high-speed transactions. The partnership with Circle is a critical component of this initiative, as Circle’s USDC infrastructure provides a robust foundation for FIUSD’s interoperability with other leading stablecoins, such as PayPal’s PYUSD.

The partnership leverages Circle’s expertise in stablecoin issuance and management, particularly through its USDC and Circle Payments Network, which are backed by cash and cash equivalents and comply with stringent regulatory standards across multiple jurisdictions. Fiserv’s ecosystem, which underpins a significant portion of the U.S. financial services infrastructure, processes billions of transactions annually, providing a massive scale for deploying stablecoin solutions. By embedding Circle’s USDC infrastructure, Fiserv clients gain access to a modern, internet-native financial layer without the need to build their own cryptographic systems, simplifying adoption and reducing costs.

Challenges and Considerations.

Despite its potential, the Circle and Fiserv partnership faces several challenges. The implementation of stablecoin solutions will be phased, subject to regulatory approvals and partner readiness, which could delay widespread adoption. Regulatory uncertainty, while mitigated by recent legislative progress, remains a concern, as the U.S. House of Representatives is still reconciling its STABLE Act with the Senate’s GENIUS Act. Compliance with diverse global regulations will be critical, particularly as the partnership aims to support cross-border payments. Circle’s commitment to regulatory compliance, evidenced by its licenses in multiple jurisdictions, provides a strong foundation, but navigating varying regulatory landscapes could pose logistical challenges.

Additionally, the success of the partnership depends on the adoption rate among Fiserv’s clients. While Fiserv’s extensive network offers significant scale, convincing traditional financial institutions to integrate stablecoin solutions may require overcoming skepticism about digital currencies and ensuring robust security and risk management. The partnership’s emphasis on compliance and bank-friendly infrastructure aims to address these concerns, but widespread adoption will likely require ongoing education and demonstration of tangible benefits.

Conclusion.

The Circle and Fiserv partnership represents a pivotal moment in the integration of stablecoin technology into mainstream finance. Further, it may be argued that this partnership represents the crossing of the Rubicon for digital currency as a form of payment. By combining Circle’s USDC infrastructure with Fiserv’s vast banking and merchant network, the collaboration enables real-time, low-cost, and borderless payment solutions, positioning both companies as leaders in the evolving financial ecosystem, and likely a point of no return for the payments landscape.