Arcesium Buys Limina to Connect Portfolio Management With Post-Trade Ops

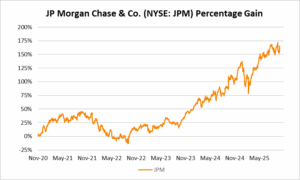

Arcesium, a JP Morgan-backed investment data management and operations company, has acquired Limina to strengthen its front-to-back investment operations platform for asset managers and institutional