We are continuing our discussion of how the largest branded payment processing networks are implementing the next generation of technology to improve their clients and their own operating performance. Mastercard (NYSE: MA) employs agentic intelligence, or AI agents that autonomously act on behalf of users, in its payment ecosystem. A combination of internally developed and off the shelf programs enable novel and improved services like the Mastercard Agent Pay, which focus on verifying AI agents, tokenizing transactions, and ensuring interoperability at every transaction stage.

Let us explain.

At the transaction level, the process begins with the registration and verification of AI agents. Only registered agents are permitted to initiate transactions on the Mastercard network. These agents must carry unique digital identities, often cryptographically linked to the user, to ensure traceability and accountability. This verification happens before any transaction, allowing merchants to recognize trusted agents and block untrusted ones without requiring significant code changes.

Safe, secure, backward compatible.

A core component is the use of agentic tokens, which are dynamic, cryptographically secure credentials formatted as Dynamic Token Verification Codes. These tokens fit into standard card payment fields, enabling backward compatibility with existing checkout systems. For each transaction, the token encapsulates details like purchase intent (e.g., cart contents and limits), consumer identity, and audit trails. This setup secures the payment and provides data for personalization, dispute prevention, and loyalty programs.

Multiple layers.

The transaction flow incorporates user consent and intent verification, often using biometric authentication to confirm the agent’s actions align with the user’s permissions. Mastercard’s system supports various integration levels: a basic no-code approach via standards like Web Bot Auth at the CDN layer for minimal effort, and deeper protocols such as Model Context Protocol (MCP), Agent2Agent (A2A), and Agentic Commerce Protocol (ACP) for advanced scalability. This allows AI agents to handle agent-assisted or fully autonomous purchases while maintaining security and compliance.

Early days of improvement.

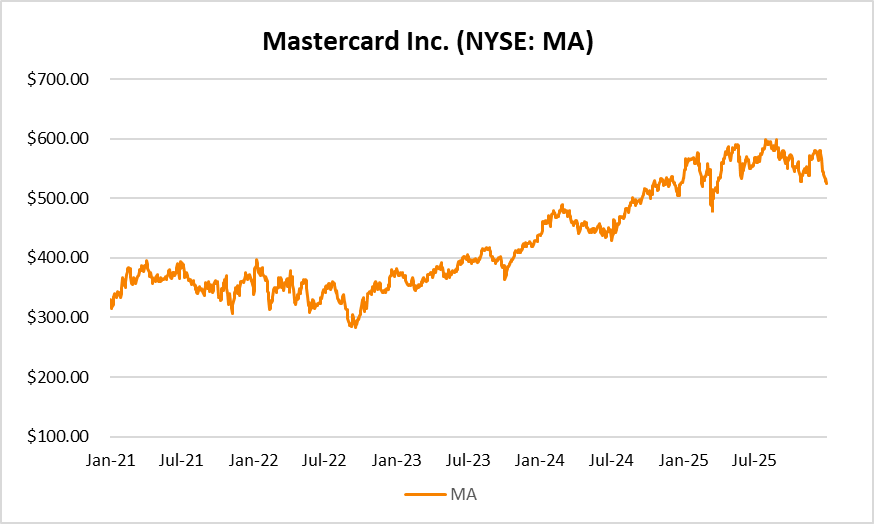

Mastercard is introducing their agentic approach to payments for the AI era by enabling machine-to-machine interactions, partnering with entities like OpenAI, Google, Cloudflare, Microsoft, and PayPal to scale solutions across consumer and business use cases. By any measure, Mastercard is already a remarkably successful company by (how about close to 60% operating margins to start), and the AI benefits to their platform could help it stay that way.