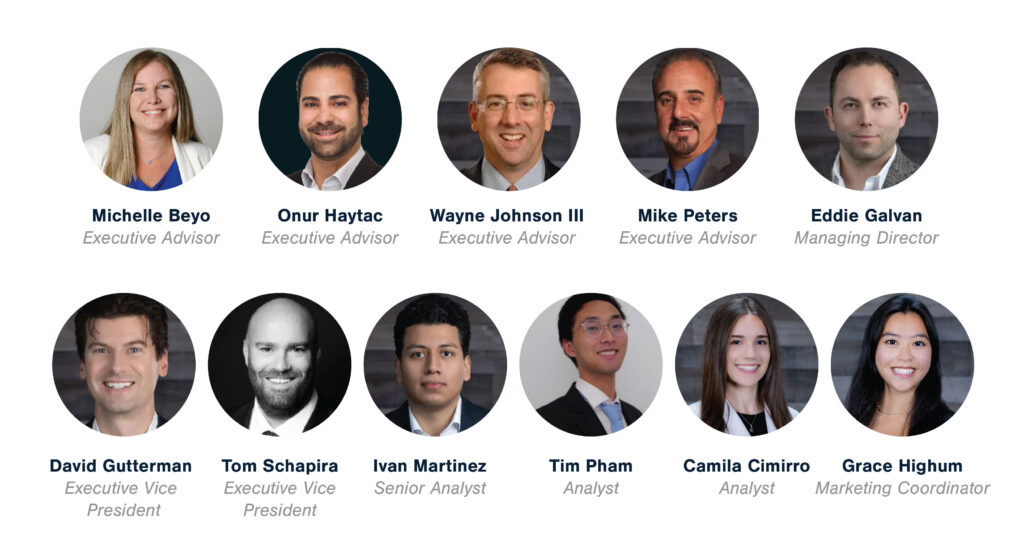

This year we doubled the size of our company!

We added four Executive Advisors with niche areas of fintech expertise, a full banking team on the West Coast, our first member covering the UK and EU, and an ace Marketing Coordinator who ensures we continue to get the word out.

A Message From Our Managing Member

2024 was a remarkable year for our young firm. To have doubled in size so quickly reflects a culture of drive, determination and grit. But a firm’s size ought not be a metric for success. It’s the members who have joined that have truly made the difference. Incorporating a best-of-breed Executive Advisory team, each with highly-specialized domain expertise, has been a tremendous value-add to our banking team and clients. The addition of our West Coast team gives us full U.S. and Canadian coverage, and our EVP in Portugal gives us reach in the EU and UK. We fully expect to continue, if not accelerate, our growth trajectory in 2025, and to that end, I want to thank in advance my partners, team members, and clients. Our objective remains clear and simple: be the best payments, fintech and B2B software investment bank and advisory firm in the middle-market.

Looking forward to 2025, I do so through the prism of artificial intelligence, convinced that we are living through a singular period in history, when the most powerful general purpose technology the world has ever seen is rapidly diffusing through all aspects of our lives, with commerce and finance at the fore. Artificial intelligence is here and its nascent contributions to fintech, payments and software will continue to be as disruptive as they are reformative, forever changing our previous conceptions of the productivity curve.

I also see the continuing post-pandemic rationalization of asset values precipitating a host of deal activity this year. As the bid/ask gap continues to close, 2025 should be a year when the public markets finally unlock, liberating high growth privates to lucrative exits, while at the same time, especially with legacy payments and software firms, take-privates will continue as shareholders seek higher valuations in private equity. Late 2024 also indicated an acceleration of liquidations from venture firms, offloading underperforming portfolio holdings, many of which being discounted technology assets ripe for the opportunistic and strategic-minded buyer.

I wish all a happy, healthy and successful 2025. It’s going to be an extremely active year.

Cheers!

We traveled around the world this year, attending conferences, hosting, and speaking on panels

2024 Transaction Highlights

Editor’s Pick for Best Articles in 2024

And that’s a wrap!